Hanover, April 4 2023

In my last blog post, I gave an overview about the kind of data and data sources that are available about customers to you as a life sciences company. Now, the question naturally arises which of this data is suitable to assess the customer engagement of HCPs and how can the engagement be improved or sustained.

Make a good impression on your HCP: Communicate less, but say more

Take the perspective of an HCP: I, as an HCP, gave a life sciences company my opt-in for digital communication. That means, I receive emails from sales reps, medical science liaison managers, marketing and corporate emails, product information, invitations to diverse online events and I get forwarded to take a look at the company website and social media. This does not sound too much, but imagine receiving all that information not only from one life sciences company, but from many life sciences companies. That is too much to handle besides the normal day-to-day work.

So, what do you do as an HCP? I choose to focus on the company, that offers me the most qualitative and interesting content. As a customer, I want to be valued. And that feeling does not arise, when I get flooded with unspecific communication materials. Ideally, I only receive information regarding topics I asked for and are interested in. And in the best case: Also information, that I did not know I needed, until I received it.

In order to make that happen as a life sciences company, I need to address the right questions, really listen to my contact, and draw the right conclusions from his answers and reactions. Then, I’m able to initiate appropriate measures.

The Veeva Pulse Report from November 15, 2022, confirmed that HCPs have intensive contact only to very few life sciences companies. These few companies have established a successful customer experience. Companies that still focus on their success in quantitative measures (amount of contact per sales rep per day) instead of qualitative content, will fall behind.

As already mentioned, asking the right questions is essential, as it is the only way to get the right data that helps me make important decisions. But it is equally critical, to also document the insights I receive from taking to HCPs or generate from the data.

Documenting these insights is challenging for many life sciences companies. For once, the commercial and medical field employees have to be willing to share their insights about what concerns HCPs. Also, knowing about problems, which the HCP encounters, is important. And after the documentation, a cross-team discussion is required, so that the right conclusions can be drawn from the gained knowledge and fitting activities can be planned for the HCP, which evoke the feeling of appreciation and bonding within the HCP.

Data for assessing customer engagement

Let’s take a look at the data, that helps you assess the customer engagement. Where do you start and which data allows me to draw the right conclusions? An essential part plays the data that comes directly from the sales rep or MSL manager: statements, feedback, and actions from the HCP. Information such as feedback towards a CLM presentation, asked questions about key messages and led discussions about the product help you derive the right conclusions about the customer engagement.

And even information such as the rejection of a medium as CLM by the HCP is important, if a sales rep, does not leave it at that and rather asks which channel the HCP prefers to receive important information. The sales rep than can follow this path. In order for the field staff to act and react this flexible, it is essential that the life sciences company provides him with the needed content, trains him AND trusts in him and his abilities as a customer consultant.

Furthermore, you should take a look at:

- information regarding the opening of delivered e-mails,

- possibly multiple clicks on links in these e-mails,

- the responses recorded in surveys,

- log-in information from company websites, including the time spent on them, and

- information on whether an HCP has watched a video on a website until the end.

Making customer engagement visible

As soon as you have gathered the relevant data about an HCP’s customer engagement, it is time to assess how engaged the customer is.

- One option is to define and implement specific attributes or characteristics in the customer profile within your CRM system, such as Veeva CRM. These attributes state the bond between the HCP and the company/product/service. But in my honest opinion, this approach falls short. It’s possible to use this information for analysis and planning activities, but you are not able to comprehend the learning path the life sciences company and field staff took, to get to this stage. What exactly was decisive, that the HCP received the attribute “engaged”? What questions were asked, what were the HCP’s reactions? And which actions were taken by the HCP that show if he is an advocate or opinion leader for my product?

- An alternative is, to take a look at the customer journey with its 5 phases and map those within the customer profile. When using this option, I have both: the information regarding the bond and the information of how this bond developed. With this approach, life sciences companies can also compare customer journey of single HCPs and derive information about similarities and differences within the customer journeys and can use these insights to define different customer clusters.

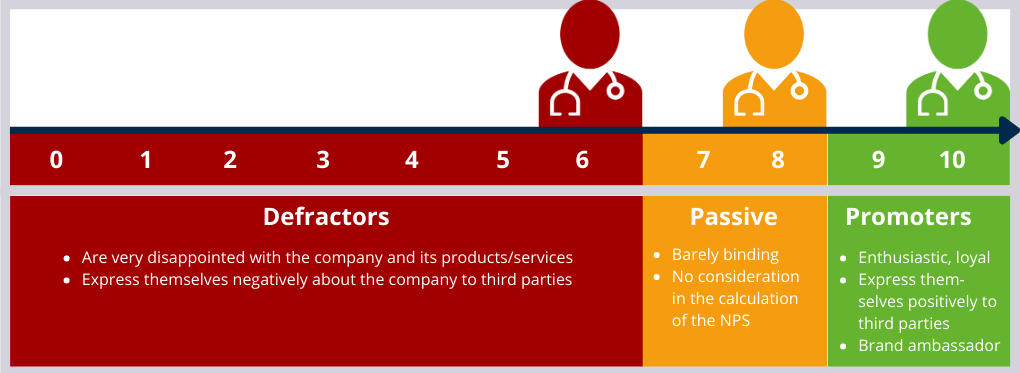

- Also, a combined approach is possible, which uses the attribute “is engaged” in the customer profile and which lets you take a look at the journey of the customer. In order to evaluate the touchpoint’s quality, the HCP can be asked for feedback regarding his customer experience. A well-suited tool for that is the Net Promotor Score (NPS). The HCP has to answer only 1 question. That could be: “How likely are you to recommend our product/life sciences company to another HCP?”. The HCP can decide on a scale from 0 to 10, 0 meaning he would never recommend it, 10 meaning he would definitely recommend it. The following classification is used to evaluate the answers:

The Net Promotor Score is calculated by subtracting the percentage of defractors from the percentage of promoters from all the feedback from customers. This way, the NPS can range from -100 to +100 and can be included in the customer profile as an important metric for the customer engagement. The NPS not only shows the engagement of a HCP towards a life sciences company, but it also allows you to derive activities to develop defractors to passives, passives into promoters and to keep promoters.

In future articles we will take up these thoughts again and consider them on the one hand in the customer journey approach (click here for an intro article on the customer journey approach in life sciences), and on the other hand also in the topic of Next Best Actions (NBA), since the use of artificial intelligence makes sense and is helpful due to the amount of data.

The next article lined up will dive deeper into customer engagement data in your CRM system, like Veeva CRM.

About me

Hello, I’m Alexander Fiedler. As a customer engagement expert I have gained diverse experience in the areas of customer relationship management and customer engagement in the life sciences industry over the past 22 years. I look forward to meeting with you in person to provide insight on how you can achieve successful engagement in the future.

Hello, I’m Alexander Fiedler. As a customer engagement expert I have gained diverse experience in the areas of customer relationship management and customer engagement in the life sciences industry over the past 22 years. I look forward to meeting with you in person to provide insight on how you can achieve successful engagement in the future.

You want more insights?

Check out our other blog articles about customer engagement!

Omnichannel-Management: From product centricity to customer centricity (3/3)

How do you measure the success of your omnichannel strategy and customer-centric approach? Learn more about possible methods for measuring omnichannel efforts.

Omnichannel-Management: From product centricity to customer centricity (2/3)

The successful implementation of omnichannel requires an organizational change away from traditional silo thinking towards customer orientation.

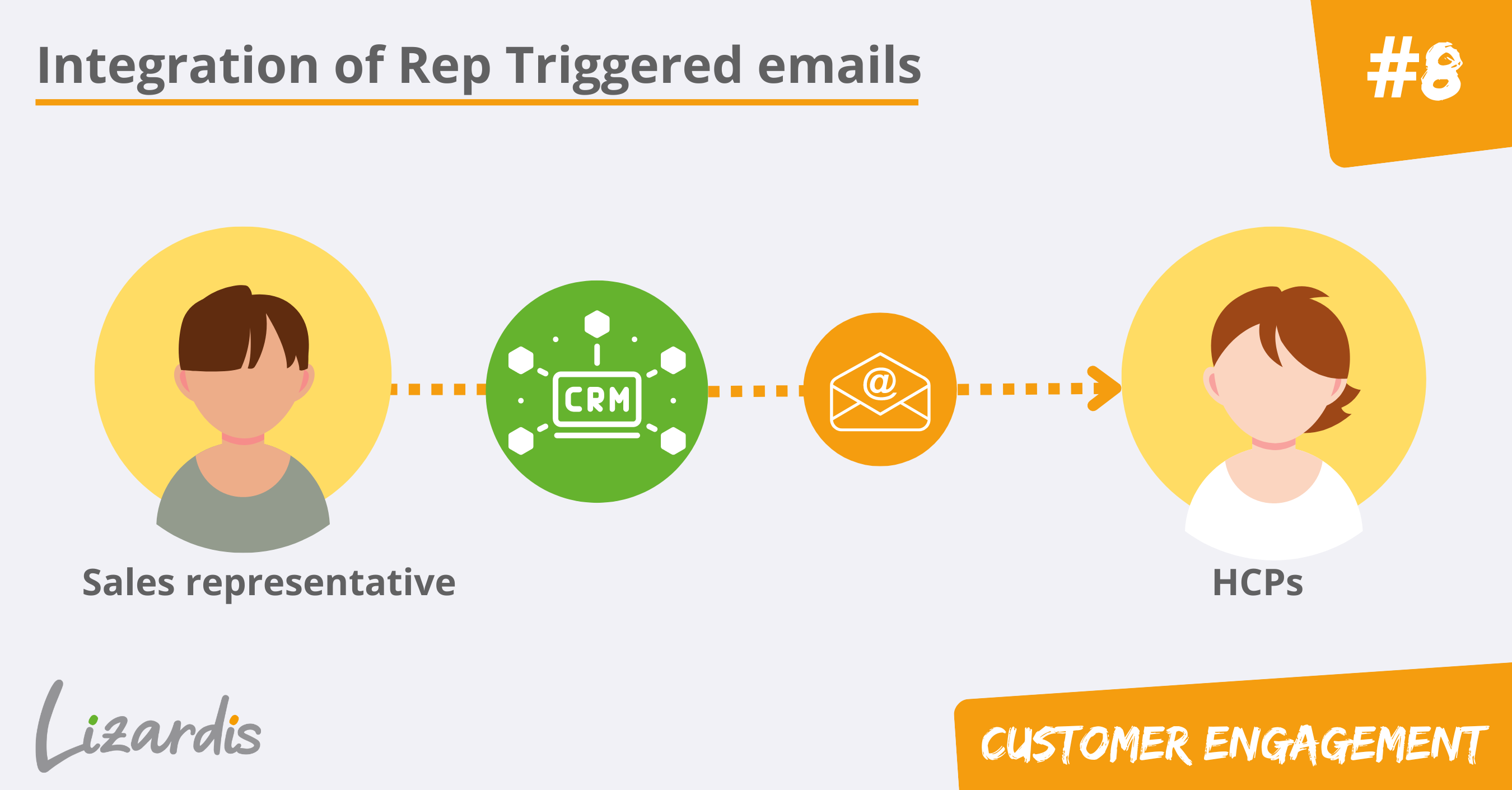

Rep Triggered Email platforms – What is the most sensible way to integrate this channel to promote customer loyalty?

In this article, I will review the so-called Rep Triggered Emails channel. I will outline what approaches exist for this channel in the life sciences industry, what tools are used and what data can be obtained in this way.

Remote Engagement – what opportunities does it offer for life science companies?

In this post, I will focus on the remote call channel (also referred to as remote engagement, video call, or video conferencing), in particular and describe how to successfully use the channel.

Use this data to assess your customer’s engagement as a life sciences company

Which data and insights help me to assess customer engagement as a life sciences company? And how can I improve customer engagement? Learn more in this article.

What customer data is available to life sciences companies?

Correct data collection & processing is not the favorite topic of many, but immensely important! Without data no information & therefore no reliable statements.

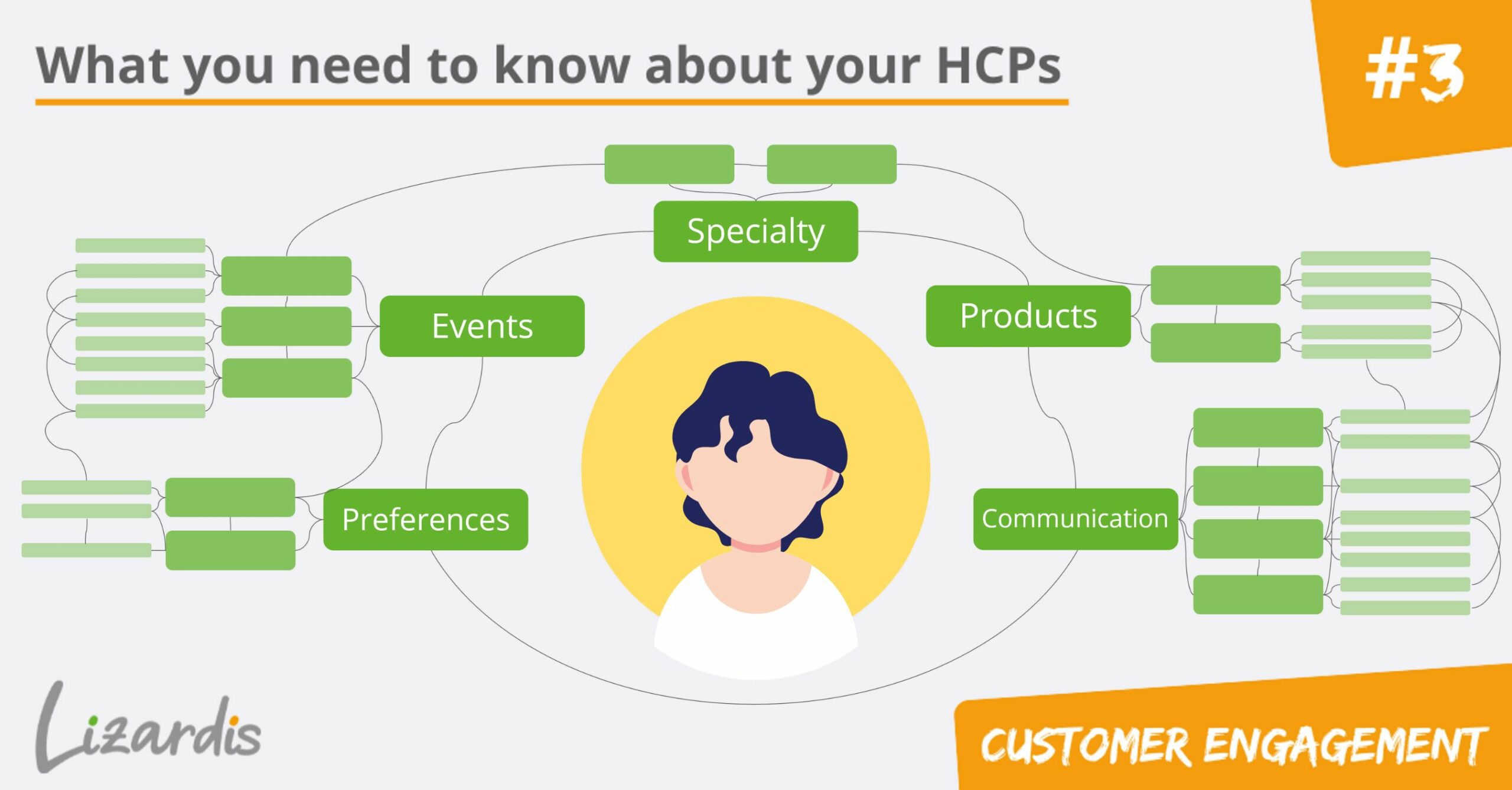

This is what you should know about your customers in the life sciences industry

Learn here, what you as a life sciences companies should know about your customers to inspire them to further engagement, and how to come to that knowledge.

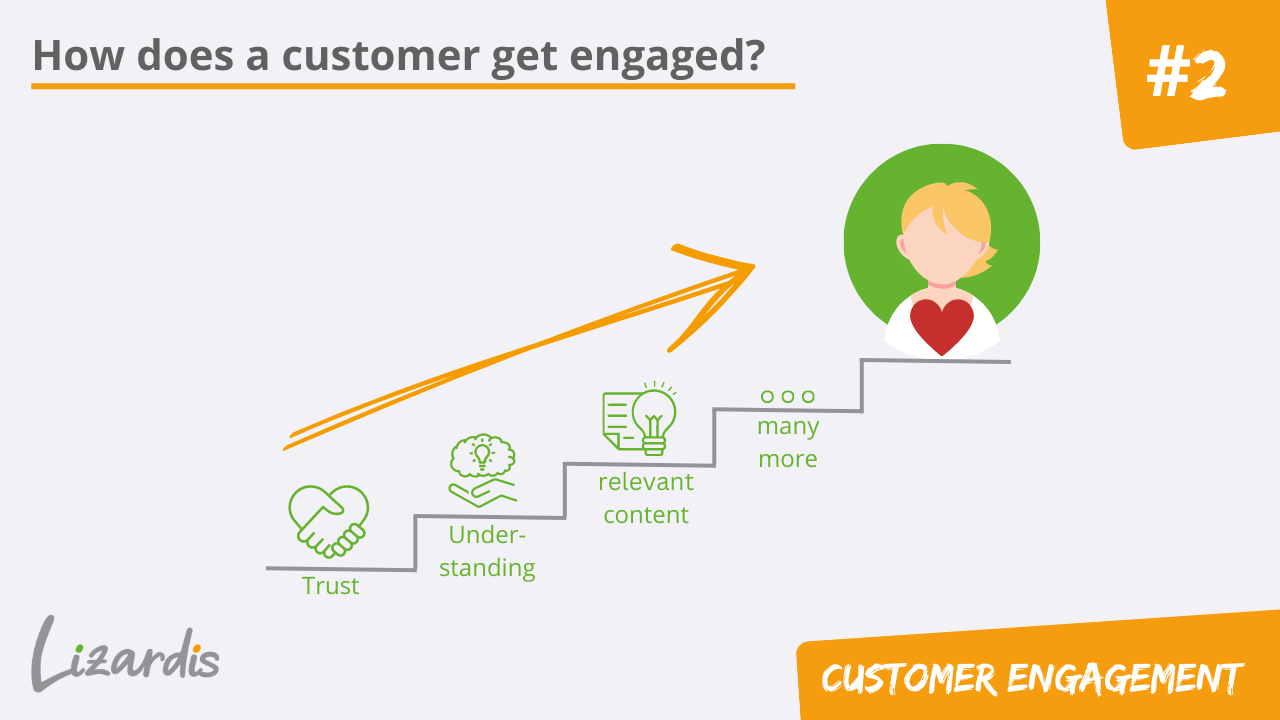

How to turn a customer into an engaged customer

There are several factors for influencing a customer to become an engaged customer. These include - amongst others - trust, understanding and relevant content. Learn more.

What is customer engagement and why is it so important?

Everyone is talking about customer engagement. But what excatly is it, why is it important and how do I optimize customer engagement? Learn more in our blog post.